Getting The Empty Home Tax Bc To Work

Table of ContentsThe 9-Minute Rule for Empty Home Tax BcThe Definitive Guide for Empty Home Tax BcThe Empty Home Tax Bc StatementsThe 10-Minute Rule for Empty Home Tax Bc

In order to deal with difficulties in the rental market in 2017, the city of Vancouver executed the vacant residences tax likewise recognized as the vacancy tax obligation. Vancouver's vacancy tax was the very first of its kind in a major Canadian city and also has actually been the version for other cities to adhere to in applying a tax of their very own.To this day, many Vancouverites are still unclear of how the tax functions, exactly how to take care of an audit, and what counts as a vacant home. In this article, we will answer numerous of the inquiries you have concerning the Vancouver vacant residences tax obligation. The empty residences tax obligation is a yearly tax related to any kind of residences or residential properties in the Vancouver area that are left vacant for even more than six months in a provided tax obligation year.

The empty homes tax obligation is one of a few steps implemented to aid the Vancouver real estate market, an additional being the international speculation tax which applies a similar tax obligation to foreign-owned residential or commercial properties. When the vacant residences tax obligation was very first implemented it set you back the homeowner 1% of the home's examined taxable value if the residential property was figured out to be uninhabited.

How Empty Home Tax Bc can Save You Time, Stress, and Money.

25% and for the year 2021, the rate will certainly increase even more to 3% of the residential property's assessed taxed value. The increase in price is indicated to put raised pressure on residential property owners to place their buildings on the rental market or to market to a person who will. For context, the typical house price in Vancouver is over $1.

On a residence of that worth, you would need to pay $39,000 a year to keep your house uninhabited. For added comparison, the Vancouver real estate tax rate is less than half a percent of your residence's worth. By leasing your home out, you would easily make back the real estate tax as well as a sizable earnings to select it.

The tax obligation Web Site just uses to "class 1 domestic" residential or commercial properties in the city of Vancouver. The tax obligation is determined annual and also every year a residential home owner is called for to submit a residential property standing declaration for the previous year. The majority of home proprietors in Vancouver will not undergo the vacant residences tax obligation.

Additionally, the vacant residences tax obligation only puts on buildings that are not the owner's major home. If the proprietor lives on the building as their primary house, there is no limit to the quantity of time they might be lacking from the residential property - empty home tax bc. Of the nearly 200,000 homes in Vancouver, the huge bulk were the principal houses of the proprietor.

The 9-Second Trick For Empty Home Tax Bc

Vacant buildings comprise the tiniest part of houses in Vancouver. A homeowner can only legally have one principal residence and as a result investors possessing numerous residential properties are more than likely to be subject to the empty homes tax. Ultimately, the tax only relates to the city of Vancouver and also buildings that drop within it.

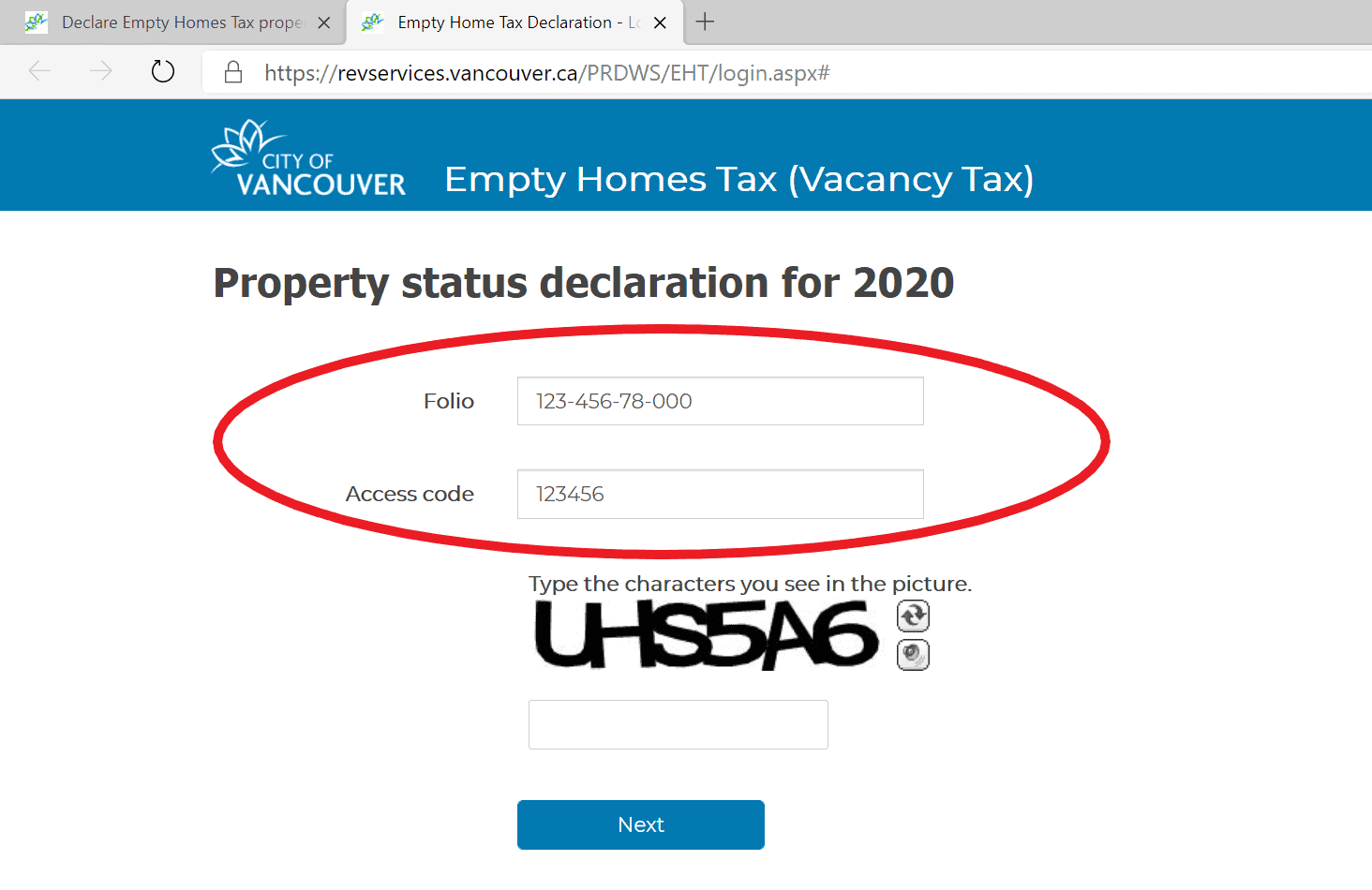

Your home status affirmation is the official means of informing the government of your building's standing. They will send you a gain access to code along with your residential property tax expense, and also after examining your property status declaration they will educate you if you are subject to the vacancy tax or not.

There are likewise countless exemptions that may apply to make you disqualified for the vacancy tax. We will cover exemptions in more information in the next section. Failing to make a residential property condition affirmation on schedule will certainly cause a $250 penalty as well as your house being deemed vacant, therefore requiring you to pay the job tax obligation.

Some of these exceptions include: A home that is empty for greater than 180 days of the tax obligation year because of a court order, court procedures, or various other orders you can find out more of lawful authority will certainly not be subject to paying the job tax obligation. If your building is subject to a strata bylaw that limits the variety of rental systems or the law restricts rentals entirely, you might not undergo the openings tax obligation (empty home tax bc).

The 9-Minute Rule for Empty Home Tax Bc

If the bylaw in inquiry was enacted after that date, the exemption does not apply. A limited-use building is any type of home that is not made use of for residential purposes despite being zoned thus. This could be due to the fact that the residential property in concern is used for vehicle car parking for instance, or that it was not qualified for a residential building as a result of home dimension or various other limitations.

A home that is vacant for more than 6 months in a year because of the resident being in extensive clinical treatment at a health center or supportive care center will not be eligible for the vacancy tax. Some problems additionally apply. As an example, the exemption does not put on residences utilized as momentary homes for the function of receiving medical treatment in Vancouver.